cayman islands tax residency certificate

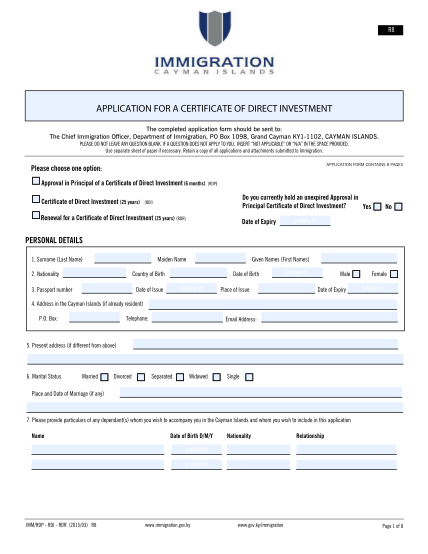

Terms referenced in this Form shall have the same meaning as applicable under the relevant Cayman Islands Regulations Guidance Notes or international agreements. Residency permit issued for 25 years and has.

Cayman Islands Non Resident Company Formation And Benefits

For each dependent there is a.

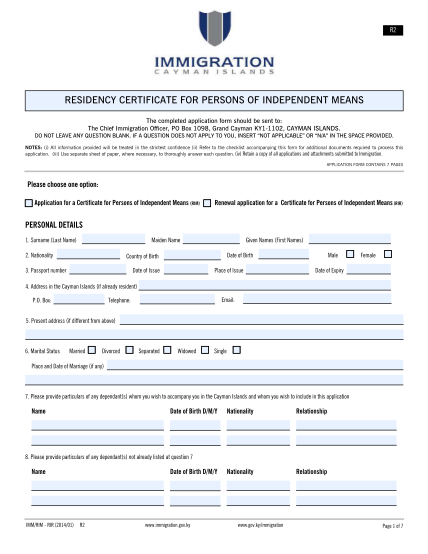

. Residency Certificate for Persons of Independent Means. There are no corporate income capital gains inheritance. In addition to Permanent Residency the Cayman Islands offers a Residency Certificate requiring just 12 million investment in real estate.

Renewable five-year workresidence visas granted within five days. A person who is eighteen years of age or older and who satisfies the requirements set out below may apply to the Chief Immigration Officer for the right to reside in the Cayman Islands as a person of independent means. The offshore zone offers very interesting conditions for real estate customers applying for residency on that ground in order.

This Certificate which is valid for 25 years and renewable thereafter entitles the holder and any qualifying dependants to reside in the Cayman Islands without the right to work. The resident permit issued by Cayman Islands covers the following family members of the investor. If the application is successful the person.

A benefactor investing in the economy receives a resident certificate which gives him or her the opportunity to live permanently in the Cayman Islands. Residency Certificate - Substantial Business Presence allows business owners andor its senior management to live and work in the Cayman Islands for 25 years. Cayman Enterprise City CEC is a special economic zone in Grand Cayman.

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. CI75000 annual income or CI400000 deposit in assets the Cayman Islands. 100 foreign ownership permitted.

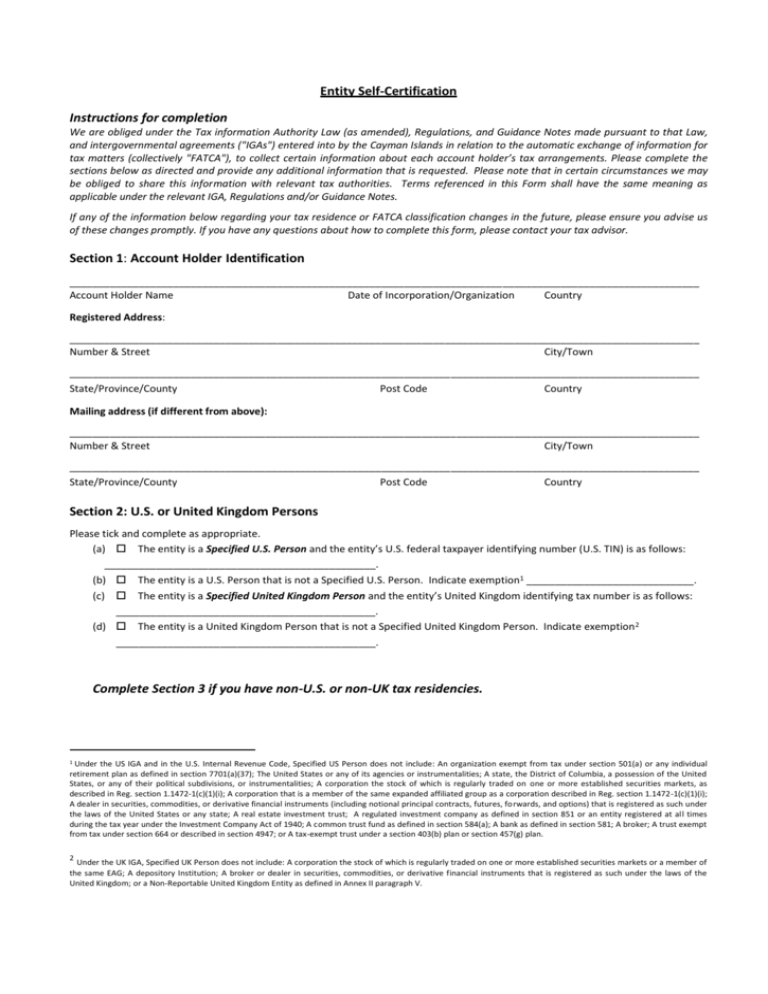

The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. Entity Self-Certification Instructions for completion We are obliged under the Tax information Authority Law as amended Regulations and Guidance Notes made pursuant to that Law and intergovernmental agreements IGAs entered into by the Cayman Islands in relation to the automatic exchange of information for. Residency Certificate for Persons of Independent Means.

What are the major benefits of Cayman islands residency. The right of dependent children to reside in the Islands shall end upon fulfillment of either condition. Individuals aged over 18 who meet certain financial requirements and make a significant investment in the Cayman Islands may apply for a Certificate for Persons of Independent Means which provides the right to reside in the Cayman Islands for a.

When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit. The category is open to persons already resident in the Cayman Islands and persons wishing to become resident. To reside in Grand Cayman the person must show proof of an annual.

If any of the information below regarding your tax residence or AEOI classification changes in the future please ensure you advise us of these changes promptly. Residence Certificate Little Cayman or Brac CI500000 investment where at least CI250000 must be in developed real estate in Brac or Little Cayman. It is available to persons who invest a minimum of CI2000000 in developed real estate in the Cayman Islands and who have financial resources sufficient to maintain themselves and their dependants.

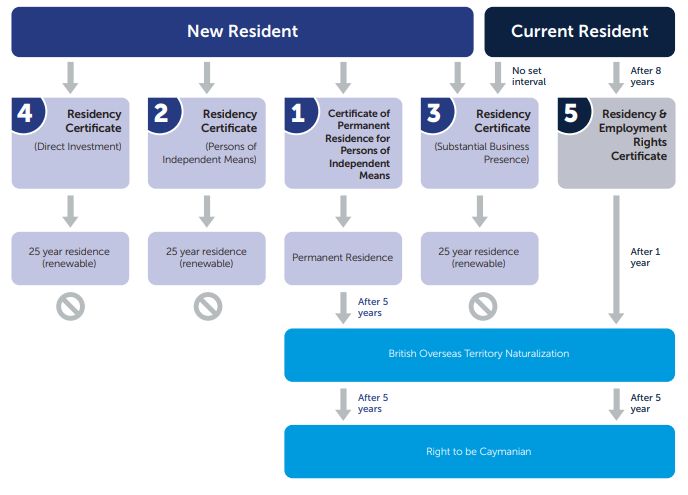

Applicants who meet the eligibility criteria and are of good character and health will be issued a Residency. Routes to Residency in the Cayman Islands 2 1 Certificate of Permanent Residence for a Person of Independent Means resulting in indefinite residence and the ability to apply to be a British Overseas Territory citizen A successful applicant will be granted indefinite residency in the Cayman Islands but will be required to submit an annual. A minimum 30 days residency is required.

Corporate - Corporate residence Last reviewed - 08 December 2021 Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation. Certificate of Permanent Residence for Persons of Independent Means grants the right to live but not work. Gain full residency and complete tax efficiency through the establishment of a corporate entity in the Cayman Islands.

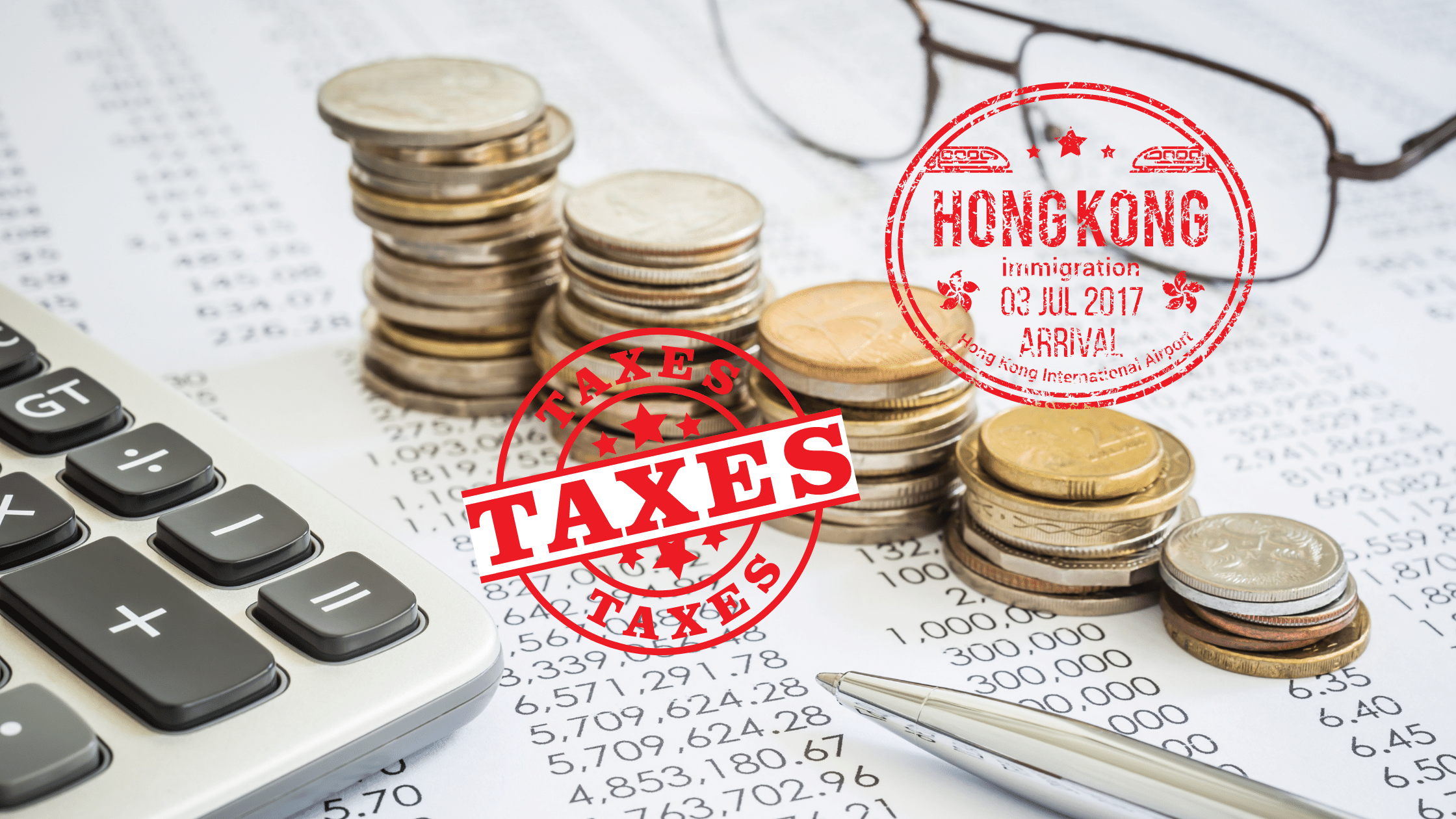

Residency Certificate Business Presence The right to reside in the Cayman Islands is available to individuals who either own at least a share in an approved category of business. Based on the current practice of the Hong Kong Inland Revenue Department IRD a Hong. A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or will be employed in a.

According to the Cayman ES Guidance v204 examples of satisfactory evidence include a tax identification number a tax residence certificate and an assessment or payment of corporate tax liability on all of the Cayman entitys income from a relevant activity in the Islands. Residency Certificate for Persons of Independent Means grants the right to live and work. It includes a state-of-the-art campus consisting of five business parks welcoming international companies from key sectors such as Internet Technology Media Marketing Commodities Derivatives Academia Training and Biotech.

This is a long-term residence category for persons who invest in or who are employed in a senior management capacity within an approved category of business. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative options. If the application is approved there is a one-time issue fee of CI100000 US12195122.

OPERATE YOUR BUSINESS TAX-FREE. There is no income tax no property tax and no corporate tax. In particular one can apply to the Director of WORC for a Residency Certificate which is valid for 25 years and is renewable.

Individual - Taxes on personal income. Residency Certificate for Persons of Independent Means. This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law.

100 exempt from corporate capital gains sales income tax and import duties. A Certificate of Permanent Residency for Persons of Independent Means offers the right to reside indefinitely in the Cayman Islands. Last updated 15 September 2020.

The fee to apply for a Certificate of Permanent Residence for Persons of Independent Means is CI500 US60975. Completion of full-time tertiary education of the child or. This Certificate is valid for 25 years and is renewable and entitles the holder and any qualifying dependents to reside in the Cayman Islands and work in the business in which they have invested or are employed in a senior management capacity.

An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000 US609757 must be in developed. You will pay an additional 1200 per dependent and you will also need to pay any annual work permit fees which vary by industry and employment capacity. CI20500 issue fee for the main applicant and each dependant must pay CI1000 fee per year.

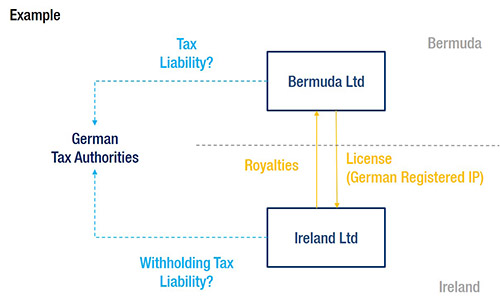

German Registered Ip New Taxation Of Transactions Between Non German Parties Tax Germany

Lowtax Global Tax Business Portal Double Tax Treaties Other Tax Information Exchange Agreements

Certificate Of Tax Resident Status Hkwj Tax Law

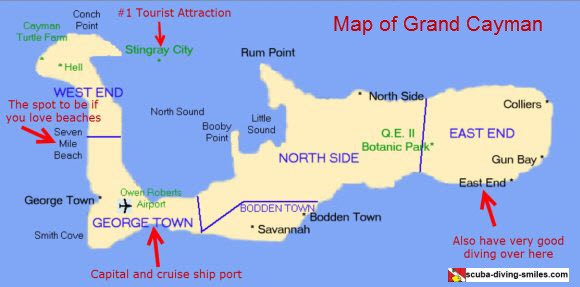

Cayman Islands Non Resident Company Formation And Benefits

Cayman Islands Non Resident Company Formation And Benefits

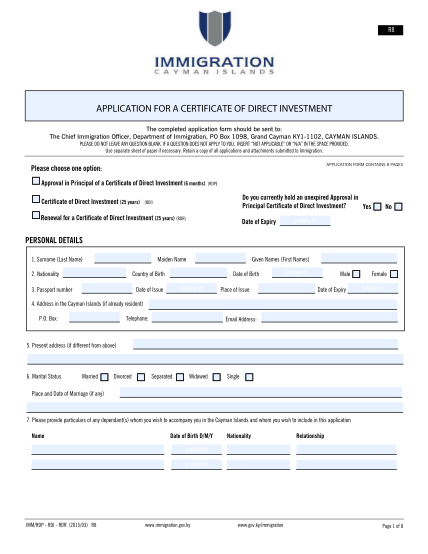

Entity Self Certification Form Cayman Islands Department Of

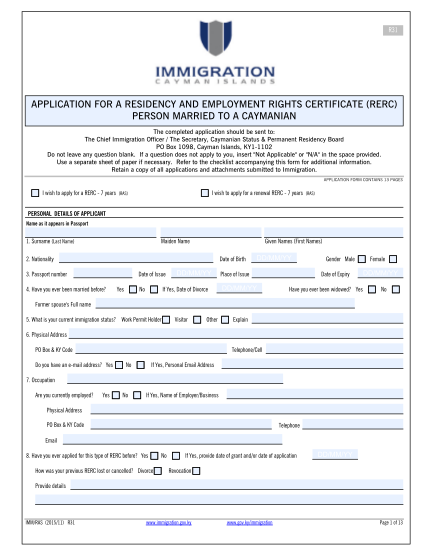

Permanent Residence For Spouses In The Cayman Cayman Resident

Routes To Residency In The Cayman Islands Immigration Cayman Islands

Cayman Islands Free Trade Zones Ultimate Guide Tetra Consultants

106 Police Report Template Page 5 Free To Edit Download Print Cocodoc

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

Entity Self Certification Form Cayman Islands Department Of

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

106 Police Report Template Page 5 Free To Edit Download Print Cocodoc

106 Police Report Template Page 5 Free To Edit Download Print Cocodoc