how do i check my sezzle limit

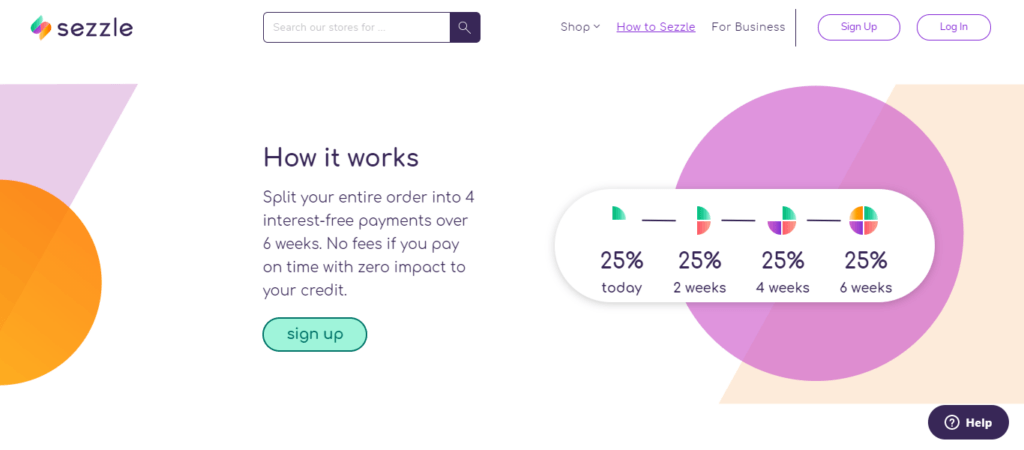

Your credit score is not affected by this soft credit check. DG Buy Now Pay Later powered by Sezzle is a payment solution that allows customers to buy now and pay over 6 weeks.

How To Increase Sezzle Limit Unitopten

Sign up today get an instant approval decision and start paying later at more than 47000 of your favorite online retailers.

. Sezzle runs a soft credit check when you apply and if your credit history is in poor shape it could cause the service to decline your purchase. If you have a smaller limit dont fret. No credit check required when applying so you dont have to worry about your score being affected.

Sezzle will break down the total cost of your purchase into smaller payments spread over at least six weeks. No reporting to the credit bureaus unless you opt in to Sezzle Up. Interest-free loans with no APR which is an interest rate thats much lower than the typical credit card.

Typically we check to make sure you have at least 25 of the total order cost available at the time the order is placed. Our automatic system reviews how long youve been a Sezzle shopper the. One of the great benefits of using Sezzle is our ability to evaluate customer limits and potential approvals with every purchase attempt.

Fast access to financing at point-of-sale with a growing number of stores that accept Sezzle. The merchant may also be experiencing some technical issues. Joining Sezzle Up is easy and if eligible you will find instructions on how to join in your Sezzle dashboard.

Sezzle was not an available payment option during checkout. Here are some things to consider to get your order approved. And we increase your spending limit so you have more buying power.

What is my spending limit. Instead every time you go to place an order our system reviews your account to determine whether or not were able to approve the order. Download the Sezzle App.

Increase your conversions AOV and customer satisfaction. March 15 2022 1535. Check out our FAQ pages for answers to the most common questions or get in touch wed love to hear from you.

How Can I Find Out My Klarna Limit. Length of time using Sezzle. Because of that we dont provide a fixed credit limit that can be maxed out Instead every time you attempt to place an order our unique approvals process reviews your Sezzle account to determine whether or not were able to approve the purchase.

It is possible that your order may be declined even if the order amount is less than your estimated spending limit as Sezzle considers a variety of factors during the approval process. Sezzle empowers shoppers to purchase today and make 4 interest-free payments over 6 weeks. When you place an order through Sezzle their unique approvals system reviews your account to determine what sort of repayment plan they can offer.

Your credit limit is also shown on each monthly statement. November 03 2020 1856. It is completely normal to start off with a smaller limit and build it up over time by continuing to use.

We will let you know by email how much credit we will offer you once you have signed your Klarna Account agreement in the checkout. Typically we check to make sure you have at least 25 of the total order cost available at the time the order is placed. Do you have sufficient funds available.

Shop for any item and use Sezzle when its time to pay. Sezzle is a payment solution that gives you the freedom to buy now and pay later - with no interest. By making your payments on time you can increase your credit score.

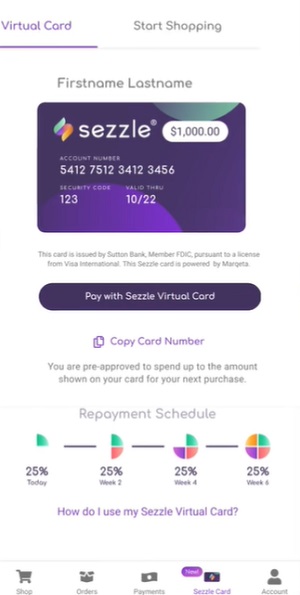

To buy items using DG Buy Now Pay Later you will apply for a Sezzle account and be provided a Sezzle Virtual Card to use for your purchase. You can always check your credit limit in the Klarna app. This should have no impact on your credit score.

Sezzle is committed to financially empowering shoppers by supporting responsible spending. Sezzle is all about financial empowerment - not helping our users dig themselves into debt. The Sezzle Virtual Card allows you to purchase from select retailers online and in-store with only.

Unfortunately Sezzle doesnt disclose a minimum credit score but the good news is that because it doesnt run a hard inquiry you can apply without fear of the process hurting your credit. Therefore our automated system does not approve 100 of orders. The overall amount outstanding on previous orders and number of orders.

When you place an order through Sezzle our unique approvals system reviews your account to determine what sort of repayment plan we can offer. Since we arent a traditional credit card or line of credit we dont necessarily provide a fixed spending amount for an account. Ad Lift order values by 20 by enabling your customers to buy now and pay later.

To access the amount you currently have available simply log into your Sezzle account and navigate to the Sezzle Card tab. Sezzle Up gives you this visibility along with the opportunity to build your credit with Sezzle. Usually sezzle are less restrictive after the first six weeks.

Sezzle is a payment solution that empowers you to Buy Now and Pay Later with simple interest-free installment plans. To help prevent fraud and verify your identity we do run a soft credit check or soft inquiry when you sign up with Sezzle. Reach 3M Shoppers in the US and Canada through our 1-Rated Buy Now Pay Later solution.

Shoppers enrolled in Sezzle Up have access to view their spending limits. We recommend contacting the merchant. It may take up to 60 days from sign-up before you see any Sezzle activity on your credit report.

If you dont see Sezzle as a payment method during the checkout process there is a chance they have either deactivated Sezzle or have an order value requirement. Here you will be able to see your available spending power along with your Virtual Card details. In most cases its 25 of the order total due up-front also called your downpayment or first.

When youre ready to check out choose sezzle as your payment method. In most cases its 25 of the order total due up-front also called your. Have the Sezzle virtual card feature at your fingertips for fast easy shopping no matter where you are.

When you sign up and are approved for the Sezzle Virtual Card we let you know right away what your limit is we calculate your limit based on a soft credit check as well as the information you provide at sign-up. Sezzle is a payment solution that gives you the freedom to buy now and pay later - with no interest. How does Sezzle impact my credit score.

When you upgrade to Sezzle Up you choose to report your payment history to the credit bureaus. Usually we are less restrictive after the first six weeks. As little as 25 is due at the time of the purchase with the remaining amount spread out over equal.

We get it sometimes you just change your mind or find something better after youve already placed an. I need to cancel my order.

Doctor Doctor Vinyl Cottage Printable Htv Adhesive Vinyl Vinyl

Here Are Some Things To Consider To Get Your Order Approved Do You Have Sufficient Funds Available Typically We Check To Make Sure You Have At Least 25 Of The Total Order

The Sezzle Business Model How Do They Make Money

Guide To Sezzle Creditcards Com

Here Are Some Things To Consider To Get Your Order Approved Do You Have Sufficient Funds Available Typically We Check To Make Sure You Have At Least 25 Of The Total Order

What Is Sezzle Payment Should You Offer It

How Do I See My Virtual Card Limit Sezzle

How Does Sezzle Stack Up Against Competing Finance Services

Buy Now Pay Later Firm Sezzle Tests The Waters In India The Hindu Businessline

The Ultimate Sezzle Review Apr 2022 A Pay Later Service For Online Shopping Ecommerce Platforms